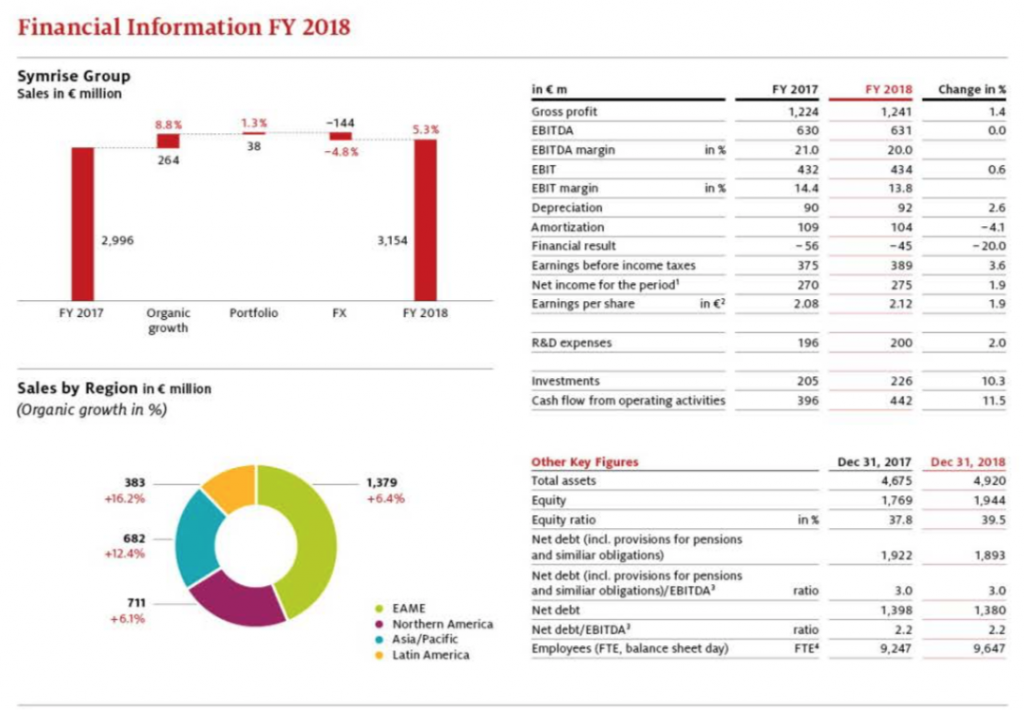

Symrise Successfully Continues Profitable Growth Course

Symrise AG took full advantage of its growth opportunities in 2018 and successfully overcame

headwinds resulting from external factors. Taking into account portfolio and exchange rate

effects, sales increased by 5.3 % to € 3,154 million (2017: € 2,996 million). On organic basis,

sales growth even amounted to 8.8 %, exceeding the increased guidance issued in late fall. This

outstanding performance was carried by all segments and regions. Despite targeted investments

in increased capacity at locations in China and the USA and negative effects from exchange

rates and raw material costs, Symrise retained its earnings power. The Group achieved earnings

before interest, taxes, depreciation and amortization (EBITDA) of € 631 million (2017: €630 million).

With an EBITDA margin of 20.0 %, profitability remained healthy and within the

target corridor of 19–22 %.

“In 2018 we seamlessly continued our success story. Symrise again grew profitably and outperformed

the market. We identified and successfully capitalized on growth opportunities in every business

segment. We also invested in future growth and added to our capacity. Although we were not able to

counteract all of the headwinds caused by high raw material prices and negative currency effects, we

still operated with a healthy profitability. We want our shareholders to participate in this success. At the

Annual General Meeting, the Executive Board and Supervisory Board will propose a dividend increase

to € 0.90 per share for the fiscal year 2018,” said Dr. Heinz-Jürgen Bertram, CEO of Symrise AG.

“Despite the anticipated economic slowdown, we have made a confident start to the new fiscal year. We

have substantiated our long-term ambition with the updated forecast. It extends into the year 2025 and

provides for a strong increase in sales with further improved profitability.”

Sales growth in 2018 exceeds target

Symrise experienced strong demand across all segments and regions in 2018 and increased its sales to

€ 3,154 million (2017: € 2,996 million). The Group achieved strong organic growth of 8.8 %, exceeding

the increased guidance announced in November, which indicated growth of over 8 %. In reporting

currency, taking into account portfolio effects from the acquisitions of Cobell and Citratus and exchange

rate effects, Group sales were up 5.3 % in the reporting period. Symrise experienced unfavorable

exchange rate effects especially through the strong Euro in relation to the US-Dollar. Symrise again

grew significantly faster than the relevant market for fragrances and flavors, where growth in 2018 was

in the 3–4% range.

Dynamic trend in Latin America and Asia/Pacific

The growth driver at regional level was once again Latin America with an outstanding double-digit

organic growth rate of 16.2 %. Business in the EAME and North America regions developed also highly

positively, with an organic increase of 6.4 % and 6.1 %, respectively. In the Asia/Pacific region, Symrise

achieved strong organic sales growth of 12.4 %. Overall organic sales growth in the dynamically

expanding Emerging Markets reached 11.7 %. In these fast-developing markets, Symrise generated 43

% of its total sales.

Healthy profitability despite investments and external factors

Earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to € 631 million

(2017: € 630 million). EBITDA was thus on prior year level, despite investments in additional capacity

and negative effects from volatile exchange rates and high raw material costs. Symrise, for example,

invested in a new Nutrition site in the US state of Georgia and a new production facility for fragrances

and flavors in Nantong, China, which is currently being built. The industry-wide shortage of raw

materials, including the key raw material Citral, which already prevailed in 2017, intensified in the past

fiscal year. However, thanks to its own raw material base and extensive backward integration, Symrise

was able to meet supplier obligations at all times and in full throughout the year. In addition, the Group

actively implemented price increases to compensate for higher raw material costs. Despite these

challenges, Symrise maintained profitability at a solid level and achieved an EBITDA margin of 20.0 %.

As a result, Symrise was once again one of the most profitable companies in the industry.

Net income for the Group increased by 1.9 % to € 275 million (2017: € 270 million). Earnings per share

increased from € 2.08 to € 2.12. The Executive Board and Supervisory Board will propose an increase

in the dividend to € 0.90 per share for the fiscal year 2018 (2017: € 0.88) at the annual general meeting

on 22 May 2019.

Increase in operating cash flow

Symrise grew its operating cash flow by € 46 million to € 442 million (2017: € 396 million). This

represents an increase of 12 % and can be attributed primarily to a smaller increase in working capital

during the year under review.

Net debt including pension provisions and similar obligations decreased by € 29 million to €

1,893 million (2017: €1,922 million). The ratio of net debt including provisions for pensions and similar

obligations to EBITDA remained unchanged at 3.0 (31 December 2017: 3.0). Due to the realized

acquisitions, this value is temporarily above Symrise’s target corridor of 2.0 to 2.5.

With an equity ratio of 39.5 % at 31 December 2018 (31 December 2017: 37.8 %), Symrise sees itself

financially very well positioned to sustainably advance the future development of its business.

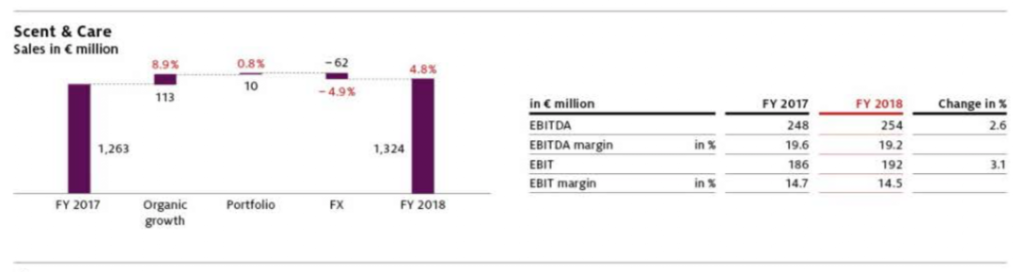

Scent & Care segment

Symrise’s Scent & Care segment under the leadership of Achim Daub increased its sales to € 1,324 million and achieved very strong organic growth of 8.9 % (2017: € 1,263 million). In reporting currency, taking currency effects and the Citratus acquisition into account, the segment posted 4.8 % growth. The Cosmetic Ingredients division developed particularly dynamically with double-digit organic percentage growth. Strong impulses came in particular from the national markets of China, Brazil and Japan. The Aroma Molecules and Fragrances division also performed well.

Demand was particularly strong for applications with menthol, for fine fragrances and personal care products.

Scent & Care increased its EBITDA to € 254 million after € 248 million in the prior year period. The EBITDA margin was 19.2 % (2017: 19.6 %). The slight decline in the margin is mainly due to higher raw material costs, especially for perfumery raw materials.

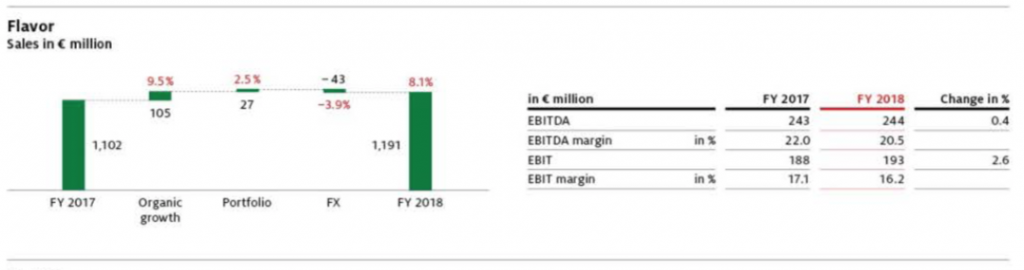

Flavor segment

The Flavor segment experienced strong organic growth of 9.5 %, with sales increasing to € 1,191 million

(2017: € 1,102 million). Taking currency effects into account and the portfolio effect from the Cobell

acquisition, sales in the segment grew by 8.1 % in reporting currency. All regions and application areas

contributed to this positive development. Flavor benefited in particular from strong demand in the EAME

region, which achieved impressive double-digit growth. Growth was driven furthermore by applications

for sweets and beverage products.

EBITDA in the Flavor segment, at € 244 million, was slightly higher than the prior-year figure (2017:

€ 243 million). The EBITDA margin stood at 20.5 % (2017: 22.0 %) and was influenced by the currently

still lower profitability of the Cobell business and higher raw material costs.

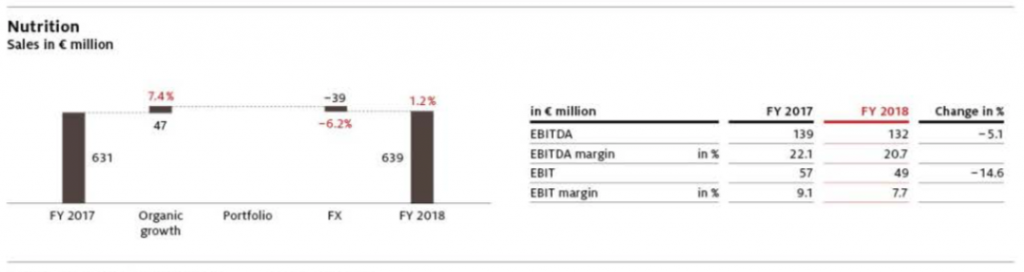

Nutrition segment

Nutrition increased organic sales in the past fiscal year by 7.4 % to € 639 million (2017: € 631 million). In

the reporting currency, including portfolio and currency effects, the segment grew by 1.2 %. The

strongest impetus came from the Pet Food application area. The Food application area also performed

well with double-digit growth.

In the year under review, Nutrition achieved an EBITDA of € 132 million (2017: € 139 million). The

decline in earnings compared with the previous year is attributable to two factors: Investments in the

new Diana Food location in the USA and a lower contribution to earnings from Probi due to a temporary

inventory decrease by a major customer in the first half of the year. Starting in the third quarter, order

intake largely returned to normal. Despite these special effects, the EBITDA margin was a good 20.7 %

(2017: 22.1 %).

Confident outlook for 2019 and ambitious long-term targets until the end of 2025

Symrise is looking ahead to the current fiscal year with confidence. The Group again aims to exceed the

overall growth rates in the relevant market. The market is projected to grow at a rate of 3–4 %

worldwide. In addition, Symrise is targeting an EBITDA margin of around 20 % despite the anticipated

economic slowdown, ongoing volatility in exchange rates and a tight market for raw materials. Overall,

with its global presence, diversified portfolio and broad client base, Symrise believes it is well positioned

to achieve these goals. With strategic investments, the Company plans to continue its expansion in

high-growth, high-margin business segments. Against the background of the tense situation on the raw

material markets, the expansion of its own backward integration will continue to play a key role in thefuture. In addition, long-term contracts and close cooperation with producers will secure Symrise’s access to high-quality raw materials.

At the Capital Markets Day in January 2019, Symrise presented its long-term targets. They underscore the Group’s ambition and now extend to the end of fiscal year 2025. By then, Symrise aims to increase sales to around € 5.5 to 6.0 billion. This increase is to be achieved through annual organic growth of 5 to 7 % (CAGR) and additional targeted acquisitions. Profitability is expected to improve further. Long-term, Symrise aims to achieve an EBITDA margin within the target corridor of 20 to 23 %. To this end, the Group will continue to systematically implement its proven strategy and closely align innovations to customer and market requirements. Furthermore, Symrise will continue to take advantage of megatrends. In addition to the traditional business with flavors and fragrances, the expansion of the portfolio will increasingly focus on adjacent, high-margin applications. For example, Symrise intends to open up growth areas, with focus on natural, sustainable product solutions. Digital business processes should also contribute to growth and profitability.

For more information, visit www.symrise.com